Introduction

A construction project If, for any reason, runs beyond the scheduled completion date of the contract to complete the Contract Works, then the Contractor would have incurred additional costs, i.e., the costs that would be incurred by the Contractor due to a prolonged contract period.

Those such costs are mainly due to maintaining on and off-site general overheads and non-productive laborers necessary to manage the site administration and management and running costs to facilities such as site accommodation and temporary facilities, key items of general plant and machinery, utility bills, and other service provider charges, and contractual costs such as insurance and guarantees, etc.

By noticing these, the prolongation costs should not be confused with the costs that are related to works, because the prolongation costs are indirect to the works, i.e., indirect costs which are predominantly being spent on time and not on work.

Basis of Prolongation cost claim

The primary basis of the prolongation cost claim is the extension of time. However, the award of an extension of time to the Contractor would not grant an automatic entitlement to the Contractor to claim for prolongation cost. Then, what is needed is to establish the basis of the extension of time to determine the merit of prolongation cost.

Though it is easier to establish, the difficult part is assessing the extent of the Contractor’s entitlement to damages, for which a rigorous account check is required to extract actual costs that were incurred by the Contractor from the overall account.

In addition to the primary requirement of an extension of time, the other important basis that should be accompanied by the extension of time is the compensable delay period. The compensable delay period can be either full and/or some days out of an overall extension of time. The term compensable delay, by definition, confirms that during a period of such delay, the Contractor is to be reimbursed for all indirect costs properly incurred by the Contractor. Hence, establishing merit for prolongation cost requires two important grounds to happen, i.e. (i) extension of time, and (ii) Compensable delay period.

Extension of time and prolongation cost claim

As we have seen the requirement of an extension of time associated with a compensable delay period for establishing the merit for prolongation cost, it is appropriate to briefly understand the different causes of extension of time in relation to prolongation costs.

The causes that give rise to an extension of time do not always grant entitlement to prolongation cost both logically and as per risk allocation to the parties in the Contract.

Typically, an extension to the Time for Completion of the Contract is awarded to the Contractor when a default of the employer, or other events that are outside the Contractor’s responsibility, occurs which critically affect the project completion, e.g., some employer risk events include access denied to the site by the employer, failed and or late issuance of design to the Contractor, authority unreasonably delayed their approvals, and a scope change initiated by the employer, etc. In such a situation the delay is termed excusable, i.e., due to the delayed completion for which the Contractor is not a defaulting party, and thus the contractor is excusable from paying delay damages to the employer. Also, the resultant delays are compensable to the Contractor due to no default of the Contractor.

However, excusable delays may also occur in other circumstances due to neutral risks (e.g., exceptional events) for which neither party is responsible. It is quite common that the completion of the project is extended if the impact of any neutral events critically affects the completion of the project. For instance, the impact of the recent global pandemic Covid-19 has critically affected the completion of many projects resulting in the completion of the project being extended.

In most standard forms of contracts, neutral risks are not assigned to any specific party. For instance, as per the FIDIC 1999 Red Book, the Contractor’s obligation to complete the Works on time is excusable when a Force Majeure event prevents the Contractor’s obligation to perform the Works as per the Contract. However, as per FIDIC 1999, Force Majeure shall not apply to obligations of either party to make payments to the other Party under the Contract. As such, the Contractor is expected to bear any additional indirect costs resulting from the neutral event. In such a case the Contractor would be granted an extension of time without any additional costs to the related prolongation period.

Another important issue that needs to be understood is the concurrent delay as it is against the merit of prolongation cost. A useful definition of the concurrent delay can be found in the case of Royal Brompton Hospital National Health Trust v Hammond as follows:

“Two or more events occurring within the same time period, each independently affecting the Completion Date.”

If an extension of time assessment and award includes an element of concurrent delay, then such a period is excluded from the calculation of the prolongation cost. The concurrent delay is excluded simply because the Contractor’s culpable delay is concurrent with the compensable period of delay caused by the Employer’s default and the Contractor is not entitled due to his default for the delay days. In such circumstances, this would have been an assertion by the Employer that the Contractor would not have achieved the completion of the project “but for” the Contractor’s culpable delay.

Preliminaries

Before discussing the assessment of prolongation cost, it is appropriate to understand what preliminaries are, because prolongation cost largely deals with preliminaries.

In almost all construction contracts there are costs to keep managing the costs directly associated with the works from the cost that are incurred by the contractors for managing and administrating the projects. A construction project involves numerous construction activities, and the completion of the project follows a sequential completion of various activities. The activity and or the work is being priced by the Contractor based on the requirement of Labor, Plant, Materials, sub-contractor, and the activity overhead and profit. The activity overheads include the supervision team, i.e., foreman and gangers. This is where the necessity of identifying the project overhead arises. This is because it is impossible to apportion the cost of project overhead into each activity and even if the apportion can be made using some formula approach it would be theoretical only.

- For example, if a project requires a Project Manager of 12 man-months to complete a dam in 12 months the cost of the project manager cannot be apportioned to each activity. Also, in the event of any Variation arising during construction, the activity unit rate cannot be taken as a benchmark to assess the variation works. This is especially difficult when such Variation does not cause a critical delay to the project. Site staff including draftsmen, Quantity surveyors, Office Engineers, etc.

- Deployment of general laborers, not related to any specific activity but, for the overall operation of the works, e.g., operation of the dewatering system, traffic management, etc.

- Staff transportation, general transport for office purposes, utility bills, etc.

- Contractual costs such as insurance, bonds, etc.

- Site establishment and related maintenance costs, etc.

- Head-office overheads such as the apportion of head-office facility costs and involvement of head office overhead for the project.

The costs arising from these similar heads are not specific to any activity but are required for the operation of the project. These costs are planned by the Contractor for the project’s duration.

Prolongation cost assessment

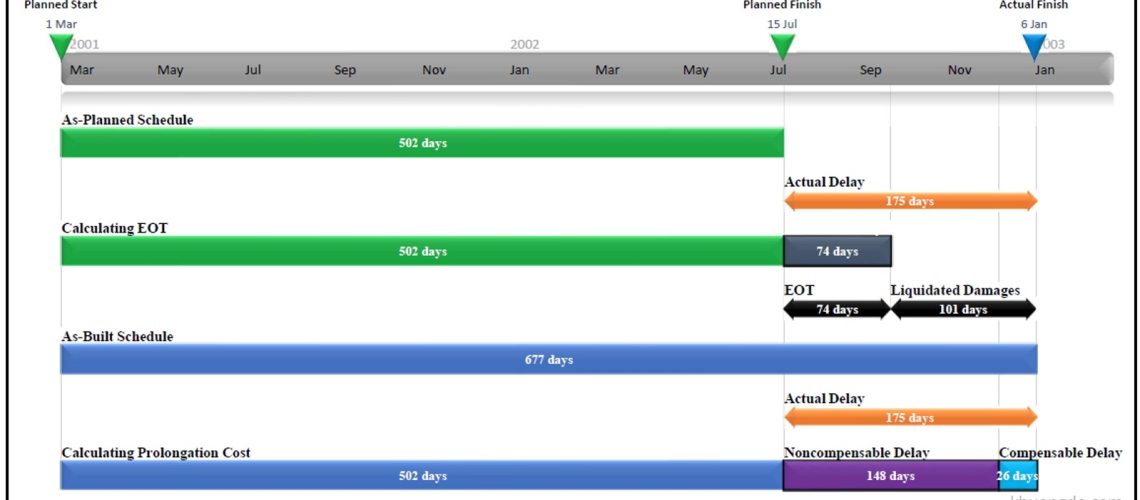

For a project with 12 months duration (Jan to Dec), if the employer instructs additional works to the Contractor on 01 March, then the impact of such varied works on the project timeline shall be assessed. There are various methods of analyzing the time impact such as time Impact analysis, As-planned versus As-built, Window analysis, etc. It is up to the project team to apply a suitable method for assessing the time impact as per the Contract.

By identifying the overall time impact, and by analyzing the non-excusable delays, the extension required to the project timeline shall be judged. If the analysis necessitates a three (3) months extension, then the completion be extended to 31 Mar, in the following year.

Once the overall critical delay to completion is concluded, it is appropriate to identify a compensable delay period, to assess the period that entitles the Contractor to claim for prolongation cost. The assessment is exampled hereunder:

The extension of time is identified as 69 days, whilst the compensable delay period that entitles the Contractor to claim for prolongation cost is 51 days.

The next aspect is cost impact. The execution of Variation would have an impact on the Contractor’s cost and the Contract Price in two ways, i.e., (i) Direct Costs, and (ii) Indirect Costs. The direct costs are related to the cost of varied works, whilst the indirect costs are related to the operation and management of the project Site, i.e., the cost of preliminaries and general items identified in the preceding section. The cost of Variation shall be assessed in accordance with the terms of the Contract. There should not be any major issues if the scope of varied work is clear and agreed upon by the Parties.

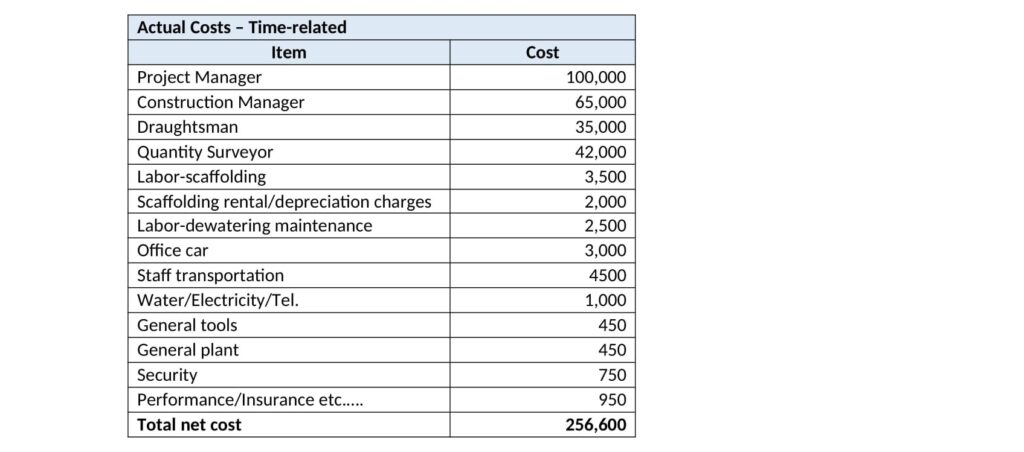

The complex area is assessing the impact on the indirect cost. In assessing the indirect cost impact, the Society of Construction Law (SCL) – Delay and Disruption Protocol, is the most relevant guidance in which the basis of calculation of compensation for prolongation shall be as follows:

“Compensation for prolongation should not be paid for anything other than work actually done, time actually taken up or loss and/or expense actually suffered. In other words, the compensation for prolongation caused other than by variations is based on the actual additional cost incurred by the Contractor. The objective is to put the Contractor in the same financial position it would have been if the Employer Risk Event had not occurred.”

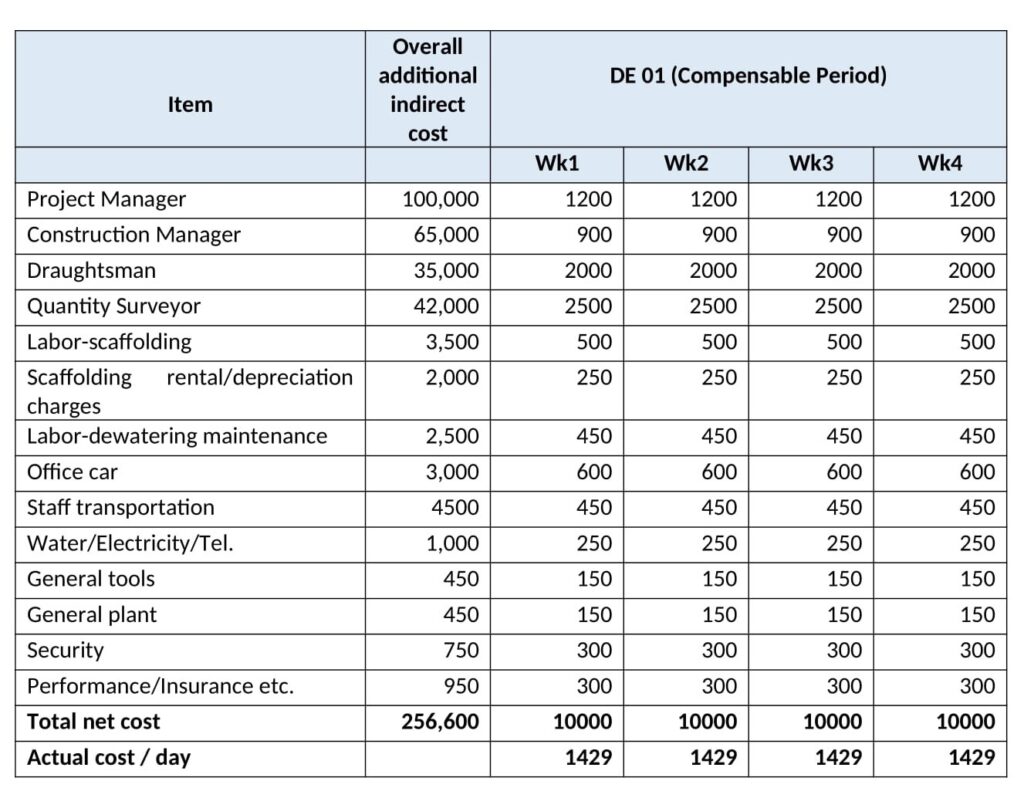

The actual time-related costs incurred during the delay period shall be calculated by identifying the period when the delay occurred. In the given scenario, the delay occurred for 69 days between 01 March and 09 May), and thus the actual prolongation cost incurred for the overall delay period shall be extracted from the cost data of the company by stripping out all other costs, which then be categorized as follows:

From the overall additional cost, the actual prolongation cost incurred during the compensable period shall be calculated. If there were multiple delay events the prolongation cost shall be calculated accordingly.

The prolongation cost arose due to the Employer’s delay event in the period where the delay event occurred, i.e., this is the planned duration for the execution of original contract works. However, due to additional works, the planned progress of the original work was now affected by two months, for which the Contractor is entitled to an extension of time.

Due to the introduction of additional works and consequently the extended contract duration, it is obvious the planned indirect cost becomes inadequate to complete the revised Contract Works. This Contractor should be compensated with such additional indirect costs. The additional indirect costs are the actual indirect costs properly incurred by the Contractor during the delay period and not during the Contract overrun period.

Also, the Contractor is not entitled to reimburse all actual costs (indirect) incurred during the delay period but is limited to reimburse the costs that were properly incurred by the Contractor. Hence, the Contractor’s entitlement to additional indirect costs is subject to the substantiation of the contractor’s submission/records confirming the cost incurred by the Contractor. To justify the properly incurred cost, appropriate justification is needed.